Satoshi's Sidewalk #10: Home Prices Way Up

Home prices are up in states with net positive migration from the lockdown fiasco.

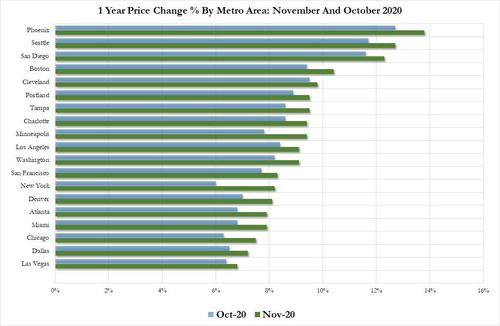

Above is a Case Shiller index chart of 19 cities which experienced the greatest home price increases year-over-year for October and November of 2020 (housing info lags a month or two). The average was 6.8% and the maximum increase, in Phoenix, was 13.8%.

I believe there are multiple factors for the price increases, which compound as the list proceeds.

Flight From Lockdown States

This one is not hard to understand. People who are tired of the lockdowns after a year. Those with the means to vote with their feet have and will continue to do so. Uhaul’s 2020 Migration Trends report puts these states at the top of the migration list: Tennessee, Texas, Florida, Ohio, and Arizona.

Normalizing Work-From-Home

Closing offices has accelerated the trend to Work-From-Home (WFH). The WFH trend creates a new opportunity: if you can work from anywhere, you can live anywhere. I believe this is akin to being the last straw. States onerous lockdown policies created the greatest need for people to WFH. States like New York and California, with strict lockdown policies, also have the highest marginal income tax rates.

It’s not a stretch to to put the two together: if you can work from anywhere, you can live a state with much lower (or no) income taxes. If a job is the only thing keeping a person somewhere and that requirement is nixed - why stay?

The Federal Reserve Lowering Target Rates to 0.00%-0.25%

The Fed, as it’s known, lowered rates back to zero in March 2020 after the S&P500 fell 50% in a matter of weeks. The economy at large is propped up by low rates. There was never going to be a slow “normalization” of interest rates to the 4%-6% range. Housing prices are determined by the buyer’s monthly mortgage payment. Mortgage rates are in part determined by the fed funds rate. Lowering the fed funds rate lowers the mortgage rates. The 30-year fixed rate mortgage is just off an all-time low of 2.75%.

The Fed Directly Purchasing Mortgage Back Securities

If people are able to get mortgages then someone on the other side has to be buying them. Enter The Fed - again. In March of 2020 the Fed announced a purchase of up to $1.25 trillion of federally insured mortgages (aka most mortgages). As of last August, the Fed had purchased $892 billion worth of MBSs. While they may be nearing the $1.25T limit, I have no doubt in my mind the Fed will continue to purchase MBS to prevent a drop in housing prices. Prior to COVID the 30-year fixed rate mortgage sat at 3.65%, or 33% higher than today.

My forecast for home prices in 2021: up, up, and away!

My takeaway of my forecast: buy more bitcoin instead of a house

Speaking of Bitcoin

Bitcoin can’t stop people voting with their feet. Bitcoin can’t buy up MBS to spur housing markets. Bitcoin can’t lower interest rates to prevent asset prices from falling.

Bitcoin can prevent the Fed’s financial machinations. Price discovery happens with sound money.

Resources and labor are redirected by the Fed’s (and state government) actions from other productive activities to build more homes and infrastructure to meet the newly stimulated and artificial demand. This misdirection of labor and resources which otherwise would not have occurred is called malinvestment. New homes require infrastructure such as streets, water pipes, sewer pipes, and electrical services. All of which would not have otherwise been built. The cost of which is included in the price of each home sold.

What happens to all these new homes, streets, pipes and sidewalks when the Fed doesn’t show up to bid? If construction only took place after the Fed’s actions, would the construction have occurred at all if no action was taken? What would have been built by the labor and materials now dedicated to housing malinvestment?

Bitcoin prevents this top-down misdirection of labor and resources. Durable goods such as buildings are long term endeavors. Wasting the least amount resources on natural & artificial geographic land is best accomplished under a bitcoin standard.